The third and final merge of Ethereum’s testnet before the long-awaited transition to Proof-of-Stake (PoS) from Proof-of-Work (PoW) has been completed. It was the last step in the coming very important merge of the mainnet. It’s expected to happen in late September (although there are doubts about this date).

On July 27, Ethereum announced an upgrade of Bellatrix to Goerli’s beacon chain, Prater, in preparation for a test network merger. On August 4, Bellatrix was activated. Two previous testnet mergers, Ropsten and Sepolia, have also been quite successful. So many people believe in a real Ethereum Merge (2.0 upgrade) this year. That’s what the market situation is telling us.

After news of Goerli’s successful transition to PoS, the value of ETH jumped from around $1,600 to $1,900 (+12%). Some traders and experts are so optimistic that they predict a significant rise in the price of this cryptocurrency during September.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

PoS vs. PoW

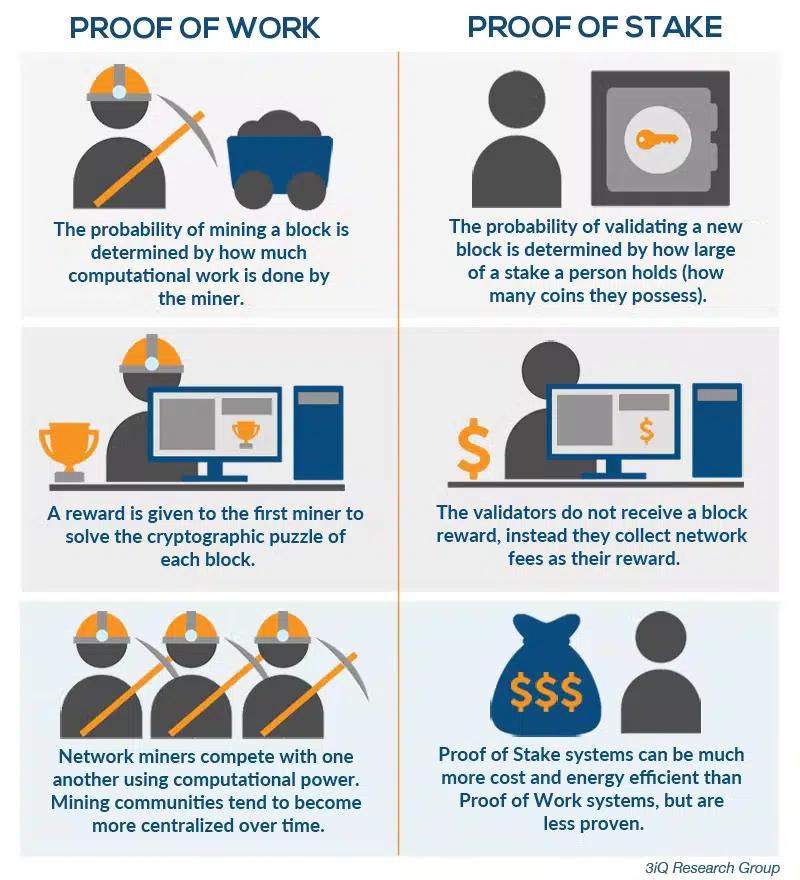

Blockchain technology can be thought of as a distributed ledger that contains a record of all previous transactions. There is no central place where it is stored. The data resides on a network of many computers around the world. The key to a distributed ledger is to ensure that the entire network collectively agrees on the contents of the ledger. This is what the consensus mechanism does. Its job is to verify that the information being added is accurate and correct, i.e., the network is in consensus. This ensures that the following block reflects the most relevant transactions in the network and prevents duplicate or invalid data from being added. There are several different consensus mechanisms with their advantages and disadvantages.

Proof-of-Stake systems are much more energy-efficient than Proof-of-Work systems. For example, the Bitcoin network requires annual energy consumption comparable to that of Colombia (57.6 TWh per year). In addition, more and more money is being invested in hardcore mining, which also increases energy consumption. The Proof-of-Stake consensus mechanism does not require energy-intensive processing power. This also makes verification more affordable than mining.

However, Proof-of-Stake is reasonably new and has not yet been tested as well as Proof-of-Work. Several potential security risks have been identified. Constant forking of the blockchain leads to instability. With Proof-of-Work, if a blockchain is forked (a split in the blockchain network), miners will have to decide whether to continue supporting the original blockchain or switch to a new fork. To keep both sides of the fork, a miner would have to divide their computing resources between them. The Proof-of-Work system naturally prevents constant forking.

Also, with Proof of-Stake, the amount of control a participant can gain over the network in the system is directly proportional to the amount of their investment. And in the Proof-of-Work system, if a miner invests more in equipment, he will also get more processing power. Therefore, it is more complex and more challenging for individuals to compete with large miners.

What’s in store for Ethereum in September

The success with Goerli and lower inflation in the U.S. lifted ETH to $2k. U.S. inflation is at 8.5%, which is suitable for Ethereum and cryptocurrencies in general. According to a Coinshares report, institutional investor participation is on the rise. Glassnode data shows an optimistic derivatives market, which should also push BTC and ETH prices up. The daily TVL (Total value locked, which shows the amount of blocked or frozen funds on a project’s smart contract or a specific liquidity pool.) continues to rise, which makes for good support for Ethereum price appreciation in the future.

Arthur Hayes, an American banker, entrepreneur, derivative trader, and Bitcoin advocate, believes that the Merge will have a strong impact on the price of ETH. It will skyrocket.

“Many of you trade stonks and understand at a basic level that a stonk is a claim on the future profits of a company. But, a company does not pay you a dividend in additional shares of stonk — it pays you in fiat currency. Furthermore, to use the services of a given company, you do not pay with the company’s stonk but with fiat currency. For Ethereum, the ‘dividends’ — or earnings you receive as a staker — are paid in Ether, AND you must bear in Ether to use the service. Stakers must also stake their Ether to earn ‘dividends,’ requiring them to lock up their funds and remove them from the market. And the more Ether stakers stake, the more ‘dividends’ they earn. So, it’s probably safe to assume that most stakers will take the Ether ‘dividends’ they earn and lock those up too. Combine that with the impact of users needing to pay Ether fees to use Ethereum (which are removed from circulation), and the rate at which Ether is issued per year will be reduced by ~90% under the new PoS model.”

After that, there will be a rapid reduction in the supply of Ether. And the more the network will be used, the more currency will have to be spent to use it.

“So the Ether taken out of circulation will only increase as the network grows in popularity (assuming it’s providing a useful service). Of course, it’s important to note that the per-transaction fees paid by users are expected to drop under the new PoS model, but even so, when you take all of these factors together, they should still drive the price of Ether up exponentially.”