Contents

It may seem that the decentralized digital world is off-limits to governments. But this is not the case. Those unfamiliar with how the NFT market works might be surprised: both sellers and buyers have to pay taxes. Ta-da!

So do not get too excited about a good deal. Unfortunately, it can be overshadowed by the taxes you pay. That’s why we’ve prepared a brief guide to NFT taxes.

So, once more: what is an NFT?

Most NFTs are part of the Ethereum blockchain, although other blockchains implement their versions of NFTs. Ethereum is a cryptocurrency like Bitcoin or Dogecoin. But in the case of NFTs, it also stores information about who trades and holds them. NFTs can be anything in digital form (such as an image, music, tweets, etc.). Mainly this technology is used to sell digital art. If you recall, Twitter founder Jack Dorsey sold one of his first tweets for almost $3 million.

Blockchain, in this process, gives the possibility to store data without having to entrust its storage and transmission to one organization. That is, everything is decentralized!

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

NFTs became mainstream last year, their trading volume skyrocketed to $24.9 billion (from $94.9 million in 2020), and the total number of NFT buyers reached 260,000 from 19,000 in the same period in 2020 (according to Q3 2021 date).

One of the reasons NFTs have become so popular among creators and investors alike is that they are adaptable in both function and form. NFT makers have created collectibles ranging from Bored Apes and CryptoPunks to generative art algorithms and NBA basketball moments. Now NFTs can give the owner additional discounts and bonuses or provide VIP access to institutions or events. And much, much more.

Get your money ready

If you’ve never sold or bought NFTs, be prepared to shell out extra money for the transaction. Of course, taxes (and their amount) depend on the particular country.

The most common taxable NFT transactions are:

- selling NFT,

- buying NFT for cryptocurrency,

- exchange of NFT for another.

There are also no taxable transactions:

- purchase of NFT for fiat,

- NFT transfer between different wallets,

- donation of NFT.

NFTs and taxes in the USA

Selling or buying NFTs on platforms such as OpenSea, Rarible, Axie Marketplace, and Larva Labs/CryptoPunks is taxable. If NFT is purchased using a cryptocurrency such as ETH, this transaction will create a taxable capital gain/loss event.

The Internal Revenue Service (IRS), which oversees the collection of taxes and the enforcement of tax laws, treats this transaction as selling ETH for fiat (government-issued currency). So, you will be taxed on the price gain from the moment you buy ETH until you exchange it for NFT.

If you’re selling NFTs for cryptocurrency or exchanging them for another NFT, it will trigger a new taxable capital gain/loss event. The IRS treats this like selling an NFT for fiat and then rebuying the cryptocurrency or other NFT for fiat. You will be taxed on the ETH price appreciation from buying the NFT until you sell it. So even if the NFT is sold for less, such as ETH, you still have to pay, for example, if the price of ETH has increased since you bought the NFT.

When you convert cryptocurrency from the sale of NFT back into fiat, you will be taxed on the price appreciation from the time you receive the cryptocurrency to the current market price when you convert into fiat.

Creating an NFT does not result in a taxable event. But if the creators sell the digital collectible for cryptocurrency on OpenSea, the consideration received will be taxed as ordinary income. In this example, if the creators do not convert the cryptocurrency to US dollars (USD) immediately, a new capital gains withholding period begins for the ETH the creators received in the sale.

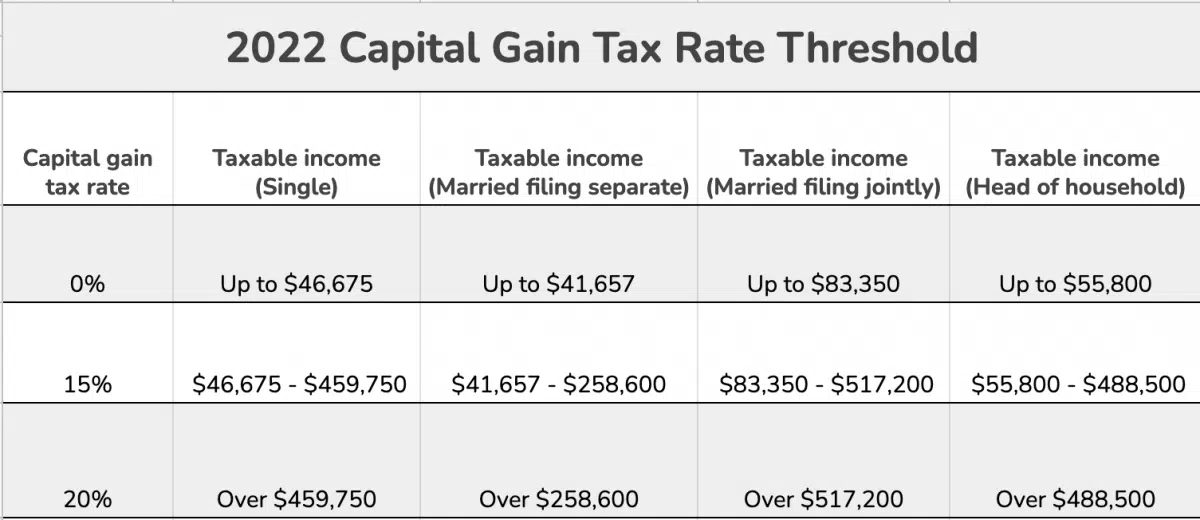

With particular NFTs, such as digital art, it is prudent to assume that they would qualify as “work-of-art” collectibles. In this case, they will be taxed at a rate higher than the taxation of cryptocurrencies. The maximum long-term capital gains tax rate for cryptocurrencies is 20% for the highest tax bracket. And the highest long-term rate for NFTs is 28%. The short-term capital gains rate for NFTs (the asset has been owned for less than 12 months) is 37%.

Some NFTs do not qualify as “collectibles.” For example, some represent ownership of tangible assets or positions in decentralized protocols such as Uniswap. In such cases, the NFTs are likely to be taxed at the typical long-term capital gains rate if it is sold after 12 months (20%).

Therefore, knowing and clarifying which category your NFT belongs to is crucial.

Some bad news for P2E gamers

Online games in which in-game assets (characters, landscapes, inventory items, etc.) are tokenized, which means they can be owned by players and converted into other types of assets, are called play-to-earn (P2E) because players can profit by performing specific actions within the game.

Games have different mechanics, but most P2E activities will be taxable because they are cryptocurrency transactions. Selling a game asset for profit will be a capital gain event, while receiving in-game purchases will likely be income.

For example, in the Axie Infinity game, players collect and mint NFTs representing digital pets — Axies. Most transactions made on Axie Infinity are probably taxable — even if your AXSgame’s token, SLP

Smooth Love Potion, the in-game digital currency, and NFTs never leave the Axie universe.

In the USA, purchasing and selling Axie, earning SLP, selling AXS or SLP, SLP gained from battles, receiving an Axie or other item as a gift, breeding Axies — all of this will be taxed. In some cases, you only have to report the income; in others, you have to pay capital gains or income taxes.

What about the EU? Is it better?

Unfortunately, things are even more complicated in the European Union. Therefore, it is often necessary to interpret general tax rules and apply them to NFT transactions. This creates considerable legal uncertainty because the interpretation of the tax rules has always been speculative. The EU VAT Act divides supplies into two categories: goods and services.

This spring, for example, the Spanish Tax Administration ruled that the supply of NFTs should be treated as a service provided electronically. In the meantime, other countries are just deciding which category to put the NFTs into.

Therefore, in each case, you need to find out which NFT you have, specify the country where the sale is taxed (the so-called place of supply), and check whether the exemption from VAT can be applied.

If the seller and the buyer are in different countries, they must specify one of those countries as the place of taxation. If the wrong country is listed, the counterparties risk twice the tax of the sale price.