Contents

The prolonged crypto winter is really hurting top companies like Twitter and Tesla. We analyzed the latest quarterly reports of public IT companies that came out the other day and were surprised at how sad things are. We’ve selected a few examples from different market segments so you can get a general overview of the amount of pain the crypto market fall is causing businesses.

What, in short, is going on?

We have already written about the tendency of wildfire from medium companies like Celsius and 3AC to larger companies. In our earlier article, we analyzed landmark changes at Microstrategy and Tesla, which indirectly signals that even such huge giants are already running out of steam.

New quarterly reports show that the same dangerous trend has spilled over into other big projects. The prolongation of the crypto winter is hurting even IT giants like Twitter. Some relative stabilization in the crypto market is not radically changing the situation, causing companies to bleed.

The brand new newsletter with insights, market analysis and daily opportunities.

Let’s grow together!

We have selected several examples from different segments that clearly show the gradual spread of the negative impact of the prolonged crypto winter.

Crypto exchanges: Coinbase

The quarterly losses of the leading U.S. crypto exchange look impressive — Coinbase’s net loss in the second quarter of 2022 was $1.1 billion. In addition to falling revenue, trading volumes are also falling; people are leaving the exchange — its trading volume has also fallen from $309 billion to $217 billion.

Coinbase’s report surprised the market so unpleasantly that the company’s stock fell 10% overnight and is losing another 6% at today’s premarket.

Crypto banks: Galaxy Digital

Galaxy Digital posted a Q2 loss of $554.7 million. The company was the first digital bank in cryptocurrency history, but now its financial situation looks contradictory.

The bank’s three-fold increase in losses is due to a recession in the cryptocurrency market and a decline in investment activity. Despite the negative numbers in the report, Galaxy Digital showed $1.5 billion in liquidity and $1.8 billion in partner capital, which provided a mild drop of just 8% in the stock.

However, the drop in the stock isn’t the biggest problem in this sector of the market. The other day, Germany’s largest cryptocurrency bank Nuri (formerly known as Bitwala), whose customers include more than 500,000 people across Europe, announced its insolvency due to the cryptocurrency market crash and, ultimately, bankruptcy.

Media: Twitter

Twitter is also experiencing problems. Its management company Block Inc reported a $36 million loss on its BTC reserves for the second quarter of this year, which also hurts its reputation. This story completely echoes the Microstrategy problems we wrote about earlier.

Mining: Marathon

Marathon Digital (MARA), the world’s largest miner, also released its Q2 financial report yesterday. Analysts had predicted revenue from Bitcoin mining at $38.8 million. In reality, the figure was almost half of that, which also unpleasantly surprised investors.

The director of Marathon explains the negative results of activity by force majeure (crypto winter and problems with logistics due to lockdowns, which slowed the delivery of new ASICs). We have already spoken about the general issues of miners in crypto winter in this article.

Independent crypto projects: Dogecoin

Dogecoin was forced out of the Top 10 Cryptocurrencies by Market Capitalization with the Polkadot token and is now in 11th place with a market value of $9.16 billion.

This drop happened despite an important announcement by the main developer about the first release of Libdogecoin, a library consisting of Dogecoin building blocks (Libdogecoin is a library that provides simplified direct integration into multiple external platforms).

Interestingly, the release of Libdogecoin was unnoticed by the stagnating market. The termination of media support for this coin by some public people — instantly led to the collapse of interest in this meme project.

Metaworlds and GameFi

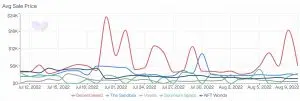

With an 85% drop in the average virtual land values of the leading metaworld projects, investors have seen that crypto winter has touched all topics and areas of digital asset development. Statisticians at WeMeto recently posted charts of price changes for four of the largest startups by capitalization.

Worlds in the Metaverse succeeded in keeping virtual land prices high through February 2022, three months ahead of the recession. Since February, the average price per plot has gradually dropped from $17,000 to $2,500 in the current month.

Crypto winter is negatively affecting the value of service tokens and shares of gaming companies that have had time to IPO and offer securities. The sell-off in the cryptocurrency market has dropped digital currencies by 80%, while stocks have fallen by a more modest percentage. They are collected in a focused fund, Metaverse ETF, whose shares have lost 45% since the beginning of the year.

However, speaking about GameFi/NFT, it should be noted that the fall here is less relative to other crypto segments. In addition, there is a more rapid market recovery, as we wrote about earlier here.